Mode360: Your 360° View of Life, Family & Finances

One coordinated plan for your retirement, taxes, estate, and family goals

Mode360 is ModeWealth’s holistic planning experience for Oregon families who want more than one-off answers. It brings your retirement, tax, estate, and family planning into a single, 360° strategy you can actually see and understand.

What Is Mode360?

An all-in-one planning experience built around your real life

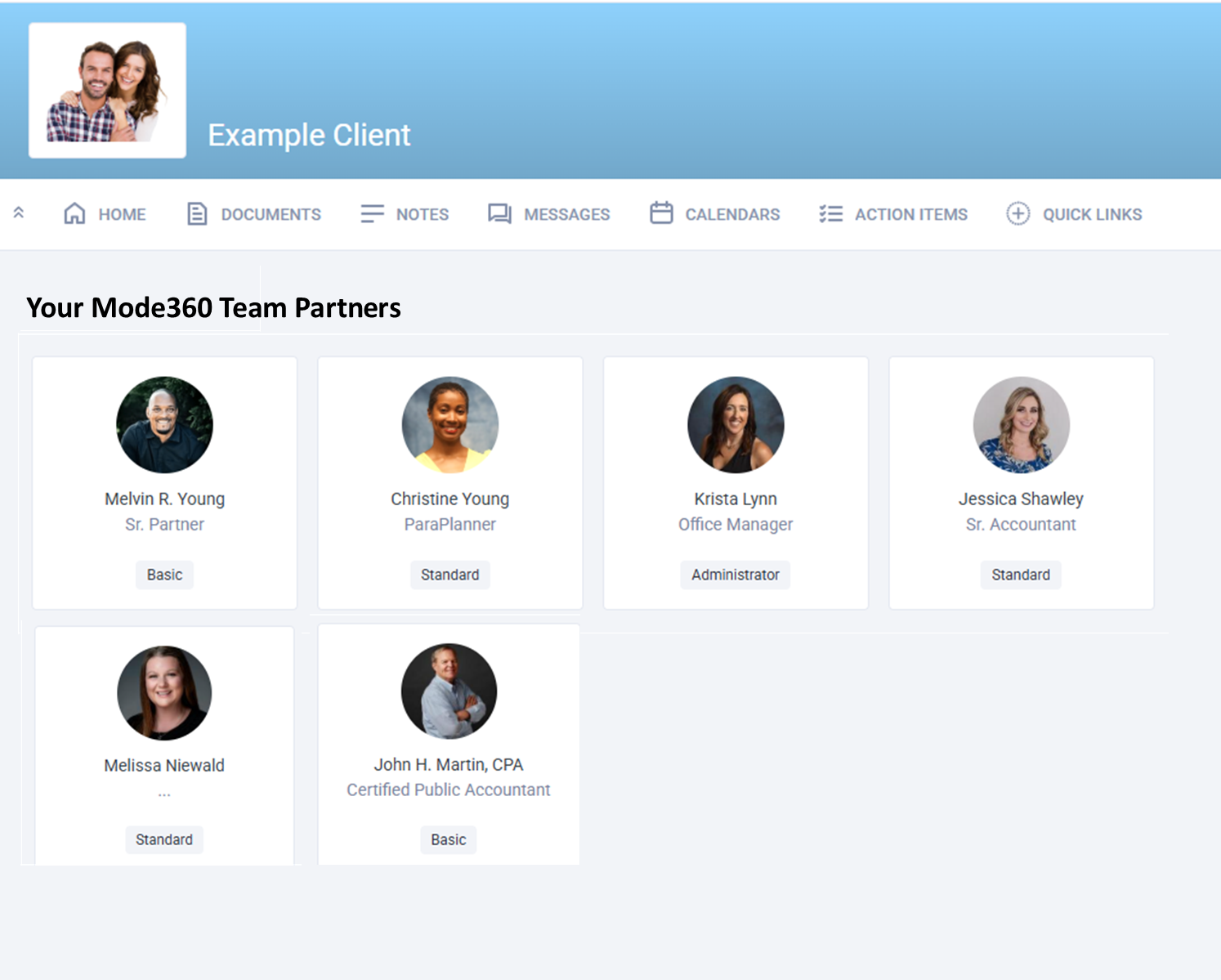

Mode360 is ModeWealth’s integrated planning platform, designed for people who want every part of their financial life working together instead of in silos. Rather than juggling separate logins, meetings, and mixed opinions, you get one cohesive plan supported by a coordinated advisory team. Using secure technology and a shared planning process, Mode360 connects retirement income, tax strategies, estate and legacy planning, and real-life responsibilities like college or caregiving. The result is a clear view of where you are today, how different decisions affect your future, and what steps to take next.

Your 360° View: What Mode360 Brings Together

Connecting the most important areas of your financial life

Mode360 keeps the key pieces of your financial picture connected so decisions in one area don’t accidentally derail another. Your plan is built to reflect your entire life, not just your investment accounts.

Retirement Planning & Income Strategies

We map a path from where you are today to the retirement you want, then design strategies to turn your savings into sustainable income. This includes Social Security timing, 401(k)/IRA coordination, and ongoing adjustments as markets and life change.

Tax-Aware and Estate-Focused Planning

Mode360 coordinates closely with our tax team to help reduce avoidable taxes now and in retirement, while also organizing accounts, beneficiaries, and strategies for efficient wealth transfer. We work alongside your estate attorney so your wills, trusts, and financial structure all point in the same direction.

Risk, Family, and Life Planning

Your plan takes into account insurance, Medicare and long-term care decisions, and other protection strategies that help guard what you’ve built. We also factor in college funding, caregiving responsibilities, and business ownership, so your financial roadmap reflects the realities of your family and career.

Technology That Keeps Your Plan in Focus

A secure Mode360 Login plus a team working behind the scenes

Mode360 uses a secure digital platform that gives you a consolidated snapshot of your accounts, net worth, and progress toward key goals—anytime you log in. You can view planning scenarios, review recommendations from your advisor, and upload important financial documents in one place, instead of chasing emails and paper statements. Behind the scenes, your ModeWealth team uses the same platform to collaborate, update projections, and keep tax strategies and planning assumptions current. Whether you’re in Salem, McMinnville, or elsewhere in Oregon, you have a shared, up-to-date view of your 360° plan.

Mode360 FAQs

Answers to common questions about the Mode360 experience

How is Mode360 different from traditional financial planning?

Mode360 goes beyond a one-time plan or investment-only focus by connecting retirement, tax, estate, risk, and family planning into a single, coordinated strategy. Instead of receiving scattered advice from separate professionals, your ModeWealth “wealth team” collaborates from one shared 360° plan. The secure Mode360 platform keeps everything updated and visible, so you can see how each decision fits into the bigger picture. It’s an ongoing experience, not just a binder you put on a shelf.

Do I need to be close to retirement to use Mode360?

No—Mode360 is helpful whether you’re years away from retirement, approaching it, or already retired. Pre-retirees often use it to clarify when they can retire, how much they’ll need, and what to adjust now; retirees use it to manage income, taxes, and legacy goals with confidence. Because the platform factors in family and life priorities, it can also be valuable for mid-career professionals and business owners who want a long-range roadmap. The key requirement is a desire for a coordinated, holistic plan.

How does Mode360 work with my existing accounts and professionals?

Mode360 is designed to organize and connect what you already have—it doesn’t require starting from scratch. We help you link or input existing accounts, policies, and legal documents into the platform so your current picture is accurate. If you already work with an estate attorney, CPA, or other professionals, we collaborate with them to align legal and tax work with your 360° plan. The goal is to bring everyone onto the same page, not replace relationships that are already serving you well.

Is Mode360 only for clients in Salem?

Mode360 was created with Oregon families in mind and is anchored in our Salem and McMinnville offices, but it’s flexible enough to support clients across the region. The digital platform and virtual meeting options make it easy to stay connected whether you’re local, in nearby communities, or splitting time between locations. At the same time, you still have access to a local advisory team that understands regional issues, Oregon tax considerations, and community resources. This combination of local insight and online convenience is a core strength of the Mode360 experience.

How do I get started with Mode360?

Getting started typically begins with a conversation about your goals, concerns, and what you’d like to see from a 360° plan. From there, we gather key information about your accounts, income, and priorities, then build an initial Mode360 view that highlights where you are today. In a follow-up meeting, we walk you through that view, discuss recommended strategies, and show you how to use your Mode360 Login. After that, you meet with your ModeWealth team periodically to review progress, adjust the plan, and keep your 360° strategy aligned with your life.